Google movements into Venmo, banks’ territory with checking money owed and up to date fee app

The tech large will allow customers to open financial institutions money owed, pay pals, and manipulate budgets via a new edition of its Google Pay app rolling out Wednesday.

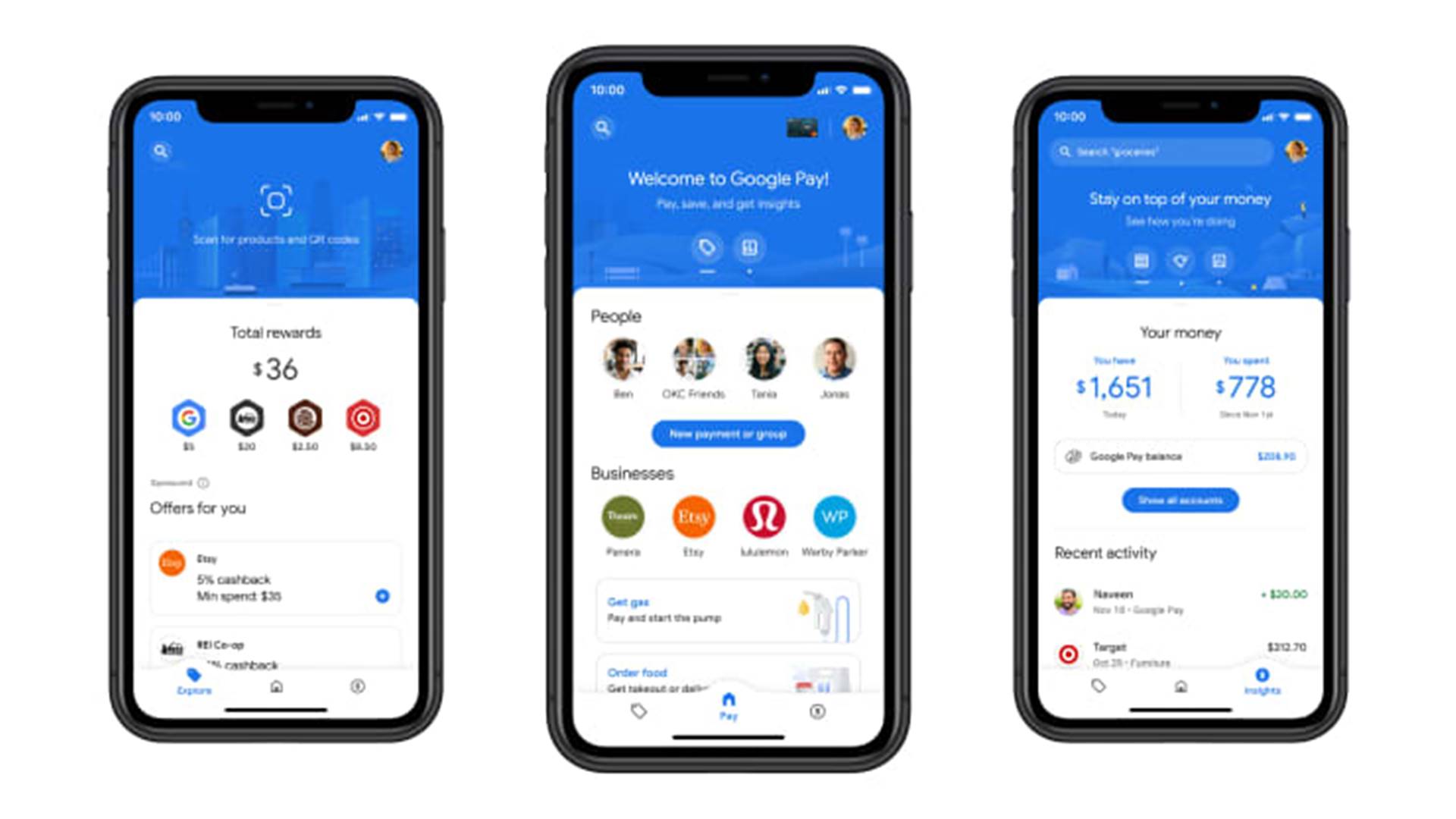

Source: Google

The Mountain View, California-primarily based totally organization partnered with Citi and Stanford Federal Credit Union to release the cell financial institution money owed and stated it plans to feature 11 new accomplice establishments subsequent year. Google Pay can even allow customers to ship peer-to-peer bills — a characteristic that made PayPal’s Venmo and Square’s Cash App family names as human beings shift to virtual bills throughout the pandemic.

“Along with our financial institution companions, we had been trying to make banking greater applicable for the cell-first generation,” Caesar Sengupta, popular supervisor of bills at Google, advised CNBC in a video interview. “It will assist our companions to make banking greater approachable to that generation, and now no longer simplest make it greater applicable, however, make it greater fun.”

Google’s declaration is the present-day pass into finance with the aid of using Big Tech. Rival Apple released its iPhone-incorporated credit score card with Goldman Sachs final year. Facebook shall we customers make bills through Messenger in sure markets. Chinese conglomerates Alibaba and Tencent have emerged as giants in bills and making an investment way to their cell bills apps.

Google’s so-called “Plex” checking and financial savings money owed don’t have any month-to-month fees, overdraft fees, or minimal stability requirements, consistent with the corporations. Users also can request a bodily debit card, to be able to run on Mastercard’s network. The Wall Street Journal reported that the partnership becomes withinside the works final year.

The new edition of Google Pay appears like and borrows a few functions from Google’s different famous products, consistent with Sengupta. Users can hyperlink Google pics to go looking for receipts and hyperlink Gmail to peer payments and subscriptions for cash management. It indicates spending summaries and developments over time. Users additionally get rewards and give primarily based totally on their transaction statistics.

Related Posts

Banking Gen Z

For the banks, those tech partnerships may be a manner to speedily develop purchaser deposits. Anand Selva, CEO of U.S. customer banking at Citi, stated it might assist the retail facet of the financial institution to construct out the countrywide scale and entice a brand new demographic.

“It’s going to have a huge appeal, however mainly some of the more youthful population, Gen Z, which are greater tech-pushed and cell-focused,” Selva advised CNBC in a telecall smartphone interview.

One potential risk for banks is that tech corporations will personal the purchaser courting and branding in those deals, preserving a beneficial part of the deal. Still, Citi’s Selva stated clients realize Citi is the only conserving the deposits.

“The account is a Citi product, however clients get excellent of each world with the Google ecosystem,” he stated. The “conventional banking version is evolving” and Selva stated partnerships have become a key part of the industry’s future.

The new line of commercial enterprise comes as Google and different tech corporations are below hearthplace over their most important income engines: advertising. In October, the Justice Department filed a lawsuit against Google and alleged that the organization has unlawfully maintained a monopoly in seeking the aid of using slicing off rivals. A file with the aid of using a Congressional Committee additionally alleged that Google used records gathered from its working gadget Android and browser Chrome to be used in its different regions of commercial enterprise.

Google stated it’ll use sure records at the bills product, which it stated is needed with the aid of using maximum cell fee carriers to offer this service. For example, Google makes use of private statistics to install and keep Google Pay account. Certain statistics are likewise required with the aid of using regulators to guard against fraud and cash laundering.

“Google Pay will by no means promote your records to 1/3 events or percentage your transaction records with the relaxation of Google for focused on ads,” the organization stated.

CNBC / TechConflict.Com