Here’s what all a success AI startups have in common

With tech giants pouring billions of dollars into synthetic intelligence projects, it’s tough to peer how startups can discover their area and create a successful commercial enterprise fashion that leverage AI

However, whilst fiercely competitive, the AI area is likewise continuously inflicting essential shifts in lots of sectors. And this creates the appropriate surroundings for fast-questioning and -transferring startups to carve a spot for themselves earlier than the large gamers circulate in.

Last week, era evaluation organization CB Insights posted an update on the reputation of its listing of pinnacle one hundred AI startups of 2020 (if you don’t know, CB Insight publishes a listing of one hundred maximum promising AI startups each year). Out of the hundred startups, 4 have made exits, with 3 going public and one being obtained via way of means of Facebook.

A nearer have a take a observe those startups affords a few correct guidelines at what it takes to create a successful commercial enterprise that uses AI. And (un)surprisingly, synthetic intelligence is a small part — albeit a vital one — of a successful product control strategy. Here are a number of the important thing takeaways from AI startups that have controlled to attain a strong reputation.

Lemonade: AI enhances a successful product strategy

Lemonade, an insurance technology startup founded in 2015, went public in July, valued at $ 1.7 billion. Lemonade is an online platform that aims to address some of the major problems facing the traditional home insurance industry. The company could develop its business through smart design and a good marketing strategy. The AI component was built on top of it.

The company’s website and mobile app are very easy to use. The process of buying insurance and filing claims using the app and website is digitally assisted and much faster than traditional insurance companies. As one of the first pacemakers in insurance, Lemonade had an advantage over other similar companies that have popped up in recent years and was able to quickly kidnap many users who were also

Interesting in the transition from a traditional insurance model to a more tech-oriented one.

Lemonade’s business model and messaging are also interesting. The company takes a flat fee of rewards, which means the company does not make a profit from rejecting claims. Unclaimed money goes to charities of users’ choice. a mission, in the words of the company, to “transform insurance from a necessary evil into a social good.

Insurance is heavily reliant on data, and established agencies have more than a century of data that they can use to develop risk models and create insurance policies. Lemonade didn’t have the data from the traditional agencies, but neither did they have their old client and policy background.

It was able to build its entire technology stack from scratch to meet the needs of an artificial intelligence factory. points that other agencies do not capture. This enables the company to create machine learning models that not only predict insurance risk with increasing accuracy over time but can also create automation and personalization opportunities that were previously impossible.

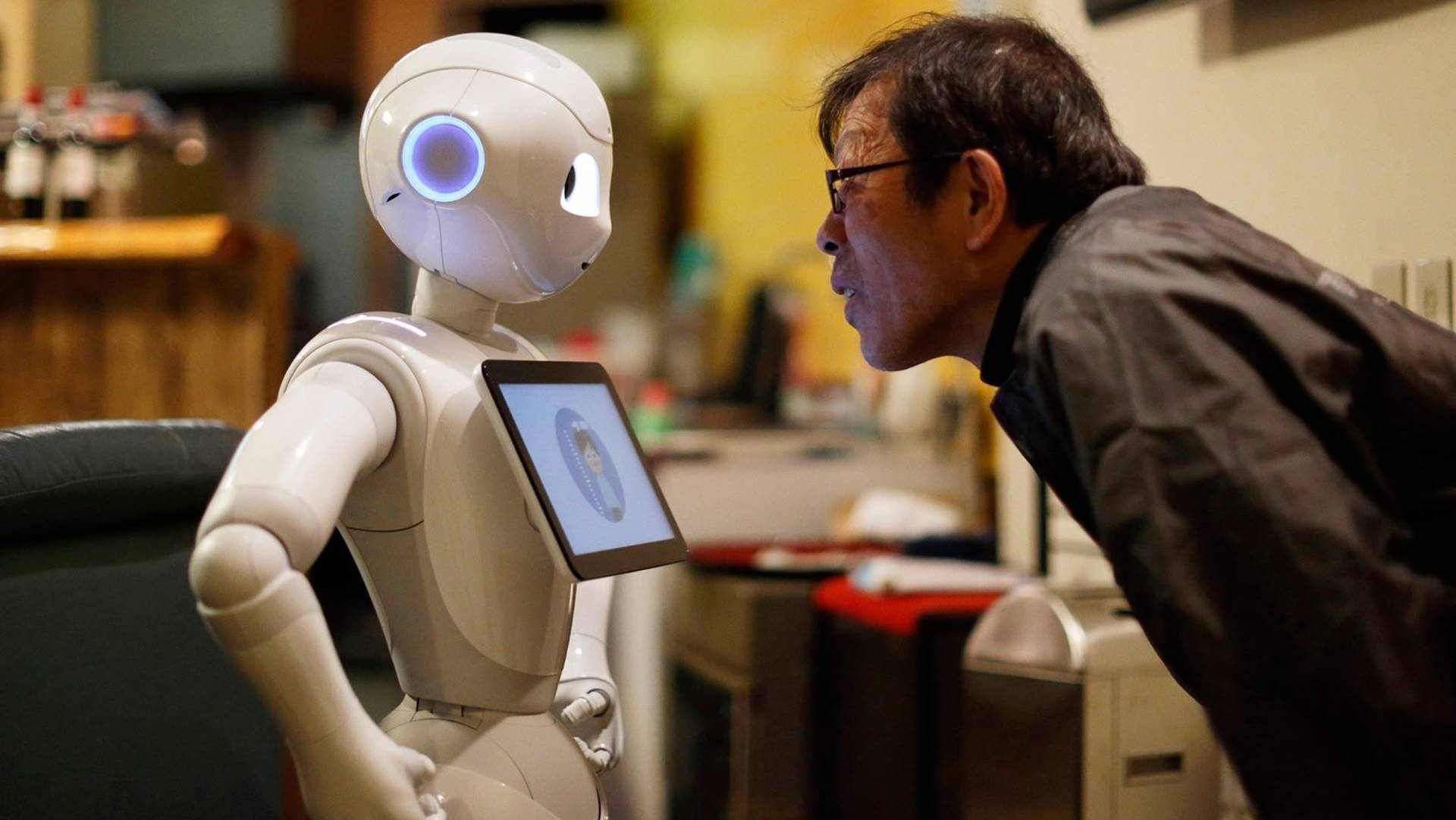

The company has two artificial intelligence chatbots: Maya helps create her insurance plan in a few minutes, and Jim handles the claims process. According to the company, AI handles a third of the cases and pays the claims on a mat. The rest of the claims are transferred to human agents. The chatbot continues to improve as it collects more data.

The company believes that over time, AI will give it an edge over traditional agencies and allow it to provide much more affordable plans for clients. And his $ 480 million pre-IPO financing and post-IPO growth show investors believe his plan can work.

Lemonade’s initial advantage is its increased protection. Other startups that would like to copy your business model don’t have your data and can’t create equally efficient AI models. And it has also created a protective pit against traditional insurance agencies, which are much slower to move to new areas. When they create their own AI factories, Lemonade will have carved out a comfortable niche for himself.

The Prospect Scenario – Study Case: FIND YOUR FREE PDF HERE!

Butterfly Network: Specialized hardware with AI enhancements

Butterfly Network will be listed on the New York Stock Exchange later this year following a $ 1.5 billion merger with Longview Capital.

The company’s product is Butterfly iQ, a medically approved whole-body ultrasound device with a probe that connects to a Smartphone and works with an associated mobile app. The device costs $ 2,000, which is far cheaper than the five- and six-digit price ultrasound devices commonly found in hospitals. The company is committed to bringing high-quality ultrasound imaging to communities that cannot afford high-end equipment, bringing portable scanning to places where the bulky ultrasound equipment cannot work.

iQ also uses artificial intelligence to make use of cases create that are not available on other ultrasound machines IQ’s AI capabilities are a slider in the app that shows the user the image quality. As the user moves the probe on the patient’s body, the slider moves to indicate whether or not the device is getting a good detection.

The feature uses an artificial neural network that has been trained on tens of thousands of images to distinguish between good and bad images. For example, in frontline responders or clinics whose staff do not have the specialist knowledge of ultrasound, the device can be used to obtain correct images and send them to experts for further analysis.

The device and app come with plenty of cloud storage and sharing features that make it easier to use data in a broader healthcare context.

The company is also working to add new features powered by machine learning to help with measurement and analysis

So here too, I think AI is a small but important part of the overall business. The greatest value comes from the hardware. The small portable ultrasound device enables Butterfly to differentiate itself from other manufacturers and create value for untapped market segments.

It’s the added value that helps you improve the software stack that is built on top of the hardware. Since the device uses consumer smartphones, it also has the potential to add new artificial intelligence features and continually improve the performance of your product as the hardware of the mobile device improves.

The only risk I see in Butterfly’s AI business is the possibility of similar moves from household names like Philips and Siemens. If the giants decide to enter the portable ultrasound business, the Butterfly Network will need to find something that can protect its products against copycats.

One possible solution would be for Butterfly to develop a privacy-friendly plan to collect ultrasound data from iQ devices to improve the performance of its AI models. But it won’t be very easy, given the sensitive nature of health data.

C3.ai: Enterprise AI can work if it has the reputation

C3.ai, another of the successful AI startups mentioned by CB Insights, is an enterprise AI software provider. C3.ai’s pre-IPO valuation was $ 4 billion, but on the first day of trading, its market cap soared above $ 13 billion.

C3.ai software helps companies build artificial intelligence models on their data for predictive maintenance, improved inventory management, fraud detection, energy management, and other operational improvements that can lower costs and increase productivity. C3.ai is not a cloud provider. services, but their software is compatible with most major cloud service providers, such as Microsoft Azure, Amazon Web Services, Google Cloud, and IBM Cloud.

Under normal circumstances, the C3.ai product strategy would be considered risky. From a technical point of view, there is no essential differentiator.

It offers services that can easily be replicated by another company that has the right resources, including the cloud services with which the software is integrated. Since its inception in 2009, the company has changed its name twice from C3 Energy to C3 IoT and then to C3.ai, which sounds a bit opportunistic a well-known and respected entrepreneur.

C3.Ai’s success does not depend on having many small customers, but rather on creating ripple effects in different sectors by attracting large customers. In that regard, having someone on board who has Siebel’s reputation and experience can make a world of difference. Currently C3. AI’s clients include machinery maker Caterpillar, Baker Hughes oil and gas services company, and Engie energy company, all big names in their respective industries.

Interestingly, 36 percent of its revenue in 2020 came from Baker Hughes and Engine.

Therefore, although C3.ai provides very good AI development tools, the success of the company can be largely attributed not to its unique AI capabilities, but rather your customer acquisition and retention strategy.

I’m not sure if that would have been possible without having someone at the helm who has strong connections across different markets and a reputation for delivering great products.

Map: the value of data

The latest company worth checking out on CB Insights’ list is Mapillary, acquired by Facebook in June for an undisclosed amount. Mapillary was launched in 2013 to create a massive street-level imagery dataset, rivaling Google’s Street View service. has collected over a billion high-resolution images of cities around the world.

Before being acquired by Facebook, Mapillary had partnered with Amazon’s artificial intelligence platform to extract information from images through computer vision.

Mapillary did not have a super-advanced artificial intelligence application or very promising roadmap to profit from your data, but your data and services could be a great addition to a larger ecosystem of artificial intelligence software, like Facebook’s. There are many ways that Facebook, which is in the business of getting to know its users better, can take advantage of Mapillary data.

For now, we know that it will integrate Mapillary data and applications into Augmented Reality and Marketplace platforms. And there are many other uses that Facebook’s AI research unit may have for exclusive access to this large dataset of street images labeled

So, I don’t see Mapillary as an AI success story, But its acquisition highlights the value of data in the AI industry. Large tech companies are often looking for ways to get exclusive data to hone their AI models and gain an edge over the competition, and they are more than willing to take a shortcut by buying the data of another company, and perhaps the entire company with it.

The wrong name for “AI startup”

I think “AI startup” is a misnomer when applied to many of the CB Insights listed companies because it puts too much emphasis on the AI side and too little on the other crucial aspects of the company.

Companies start by addressing an overlooked or poorly resolved problem with a solid product strategy, giving them the minimum market penetration necessary to establish their business model and collect data to gain insight, steer their product in the right direction, and train machine learning models. Ultimately, they use AI as a differentiator to solidify their position and maintain an edge over their competitors.

No matter how advanced, AI algorithms alone won’t work. This article was originally published by Ben Dickson at TechTalks, a publication that examines trends in technology, how they affect the way we live and do business, and the problems they solve.

The bad side of technology, the darker implications of new technologies, and what to watch out for. You can read the original article here.

Thenextweb / TechConflict.Com